THE DOOMSDAY PORTFOLIO

Scenario One: Russia takes over Ukraine

Scenario Two: Ukraine fights back and Russia gives up without forcing any concessions.

Scenario Three: A deal is made and, at the very least, Ukraine agrees not to join NATO and Russia takes their military out. Sanctions will be lifted.

Countries will still try to reduce their dependencies on products made in Russia and possibly Ukraine. But also, many of Ukraine's supply and demand issues right now because of invasion will keep their exports prices high.

Other scenarios are far worse and probably less likely.

Scenario Three is not total Doomsday (hence, we hope for it) but already things have changed:

A) the rest of the world will be less likely to deal with Russia

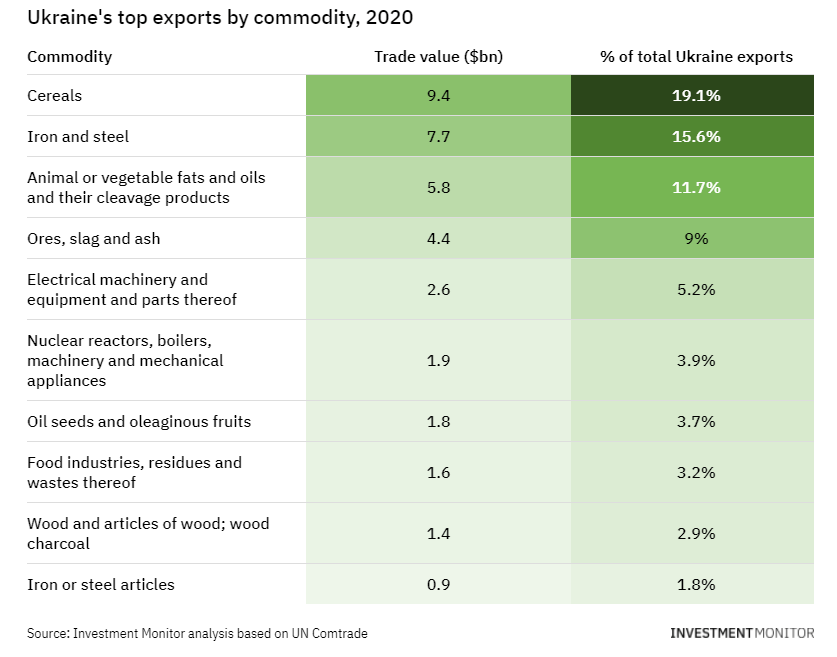

B) the natural resources that are in the Ukraine (their harvest, for instance) has already been affected so even if things are not as bad, prices will still probably remain high for wheat, etc.

Here are the Tickers below...

Scenario Two: Ukraine fights back and Russia gives up without forcing any concessions.

Scenario Three: A deal is made and, at the very least, Ukraine agrees not to join NATO and Russia takes their military out. Sanctions will be lifted.

Countries will still try to reduce their dependencies on products made in Russia and possibly Ukraine. But also, many of Ukraine's supply and demand issues right now because of invasion will keep their exports prices high.

Other scenarios are far worse and probably less likely.

Scenario Three is not total Doomsday (hence, we hope for it) but already things have changed:

A) the rest of the world will be less likely to deal with Russia

B) the natural resources that are in the Ukraine (their harvest, for instance) has already been affected so even if things are not as bad, prices will still probably remain high for wheat, etc.

Here are the Tickers below...

Preview

No comments.